The JobKeeper wage subsidy will continue until March 2021, but it won’t look the same after September.

Update 26/08/20: the government has announced that businesses that are no longer eligible for JobKeeper payments when the new scheme kicks into gear in September could still be allowed to hold onto some of their JobKeeper-specific workplace powers – such as reducing employees’ hours by up to 40 per cent if they can prove their turnover has been impacted by 10-30 per cent. Labor has signalled it will support this legislation, according to a Sydney Morning Herald report.

‘The end date of the federal wage subsidy JobKeeper has been postponed from September this year until March 2021. There were rumblings that something like this was coming, including a possible plan to extend some sort of wage subsidy exclusively to those industries hit hardest by COVID-19.

However, given both the bureaucratic difficulty of such a targeted change and the fact that many businesses across all industries are still struggling, the government has announced the wage subsidy will be extended for eligible employers for another six months. This avoids a fiscal cliff and gives organisations more certainty during a time when the course of the pandemic remains unpredictable.

However, adjustments are being made to the subsidy. After the initial planned end date employers will receive less money than they do under the current scheme, and tweaks to the eligibility requirements will mean some organisations will no longer be eligible for payments after September.

Here’s what HR needs to know.

Tiered payments

In a move it says addresses a criticism of the current scheme – that some employees are actually receiving a pay rise – from 28 September, the government is giving JobKeeper two tiers: high and low.

Which employees belong in which tier will be determined by hours worked in the four weekly pay periods ending before 1 March 2020 (i.e. before the pandemic hit Australia).

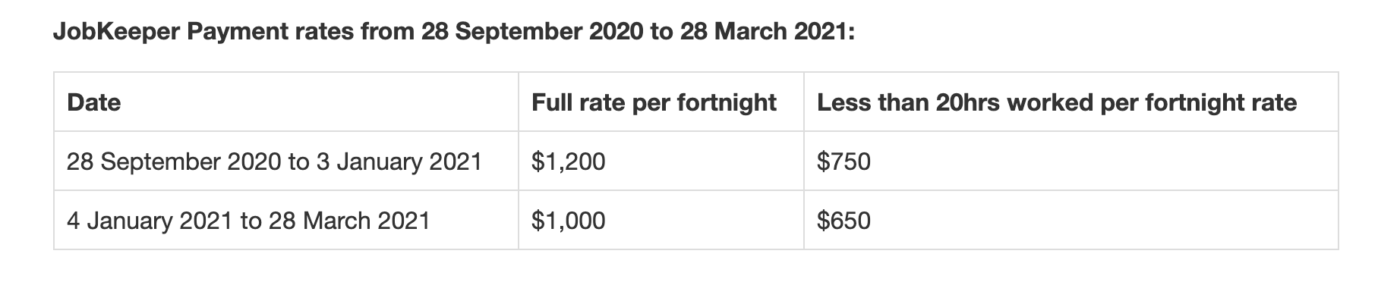

Eligible employees who worked 20 hours or more per week during this time are placed in the high tier. They will be allocated $1,200 per fortnight (instead of the current $1,500 payment) until 3 January, 2021. After this, they’ll get $1,000 until the new 28 March cut-off.

Employees who worked less than 20 hours within that time frame will be placed in the lower tier. These workers’ employers will be eligible to claim $750 per fortnight until 3 January, 2021. After that they’ll be allocated $650 until 28 March, 2021.

The hope is that the tapered payments will align with growth of Australia’s economy, which would mean businesses can be less reliant on government assistance.

“[This will] encourage businesses to adjust to the new environment, supporting a gradual transition to economic recovery, while ensuring those businesses who most need support continue to receive it,” treasurer Josh Frydenberg said in a media release.

For employers using the scheme to top up employee salaries, this news might not change much. But for some employers relying solely on these payments to keep their staff employed, this news is bittersweet.

Currently around 960,000 employers are accessing JobKeeper payments (that’s the equivalent of about 3.5 million employees), and estimates suggest only a little over a half of those employees will remain eligible after September. The government has predicted around 1.4 million Australians will be eligible and covered by JobKeeper 2.0 in the December quarter, and that this number will drop by 400,000 people in January.

New eligibility standards

Most crucially for HR, what makes an employee eligible for JobKeeper has not changed (you can read about that in HRM’s initial coverage). The changed standards relate to business eligibility.

The numbers and rates remain the same, so:

- Businesses with an annual turnover of less than $1 billion can claim if they have a revenue shortfall of 30 per cent or more.

- Businesses with an annual turnover of more than $1 billion can claim if they have a revenue shortfall of 50 per cent or more.

- Registered charities and not for profits can (excluding schools and universities) can claim if they have a revenue shortfall of 15 per cent or more.

However, forecasting a decline in revenue is no longer accepted. Businesses have to be able to demonstrate they’ve experienced a loss of revenue in the relevant quarters – so both June (April, May, June) and September (July, August, September).

Business eligibility will be reassessed at the end of September 2020 and again January 2021 (with January tests having to include proof of a revenue loss in the adjacent quarter – October, November, December).

For most businesses, the eligibility test will involve demonstrating a revenue loss as compared to the revenue they generated in a comparable period (most likely 2019). But, if for some reason this is inappropriate, the ATO has discretion to organise alternative tests.

Importantly, businesses that are currently utilising the scheme but are unable to provide evidence of the relevant losses will continue to receive payments up until the originally proposed cut-off of 28 September 2020.

Businesses that aren’t currently receiving JobKeeper payments are allowed to apply for JobKeeper 2.0.

JobKeeper payments will continue to be made by the ATO to employers in arrears and employers are still required to pass on the full amount to staff (before tax).

The extension of the billion dollar wage subsidy is expected to cost an additional $16.6 billion.

Stay on top of your employment law obligations with AHRI’s short course introduction to HR law.

What else is new?

The government has also announced that the Coronavirus Supplement for those on income support will be extended until 31 December 2020. However, the amount of money will also be decreased.

As it stands, people receiving JobSeeker payments (formerly Newstart) are currently receiving $550 on top of their baseline payments which range from around $510-$800 per fortnight. From 25 September until 31 December 2020, this supplement will sit at $250. This new boost is expected to cost $3.8 billion.

“Sadly, as a result of this global health pandemic, businesses will close and people will lose their jobs, but that is why we have extended the Coronavirus Supplement and announced a new skills package to help people transition from welfare to work,” Frydenberg said in the media release.

Minister for Families and Social Services Anne Ruston added: “We are also increasing the income free area for JobSeeker Payment and Youth Allowance (other) to $300 a fortnight to encourage and support recipients to take up job opportunities as businesses reopen.”

This means people can earn up to $300 per week and still be eligible for their full JobSeeker payment.

Is JobKeeper 2.0 going to affect your workplace? Let us know in the comments section below, or reach out (kate@mahlab.co) if you’d like to share your story.

So when it comes to claiming jobkeeper by the employer, will they have to create 2 lists – 1 for tier 1 and 1 for yier 2 employees. Will employees have to nominate again for jobkeeper? Tier 2 payments will incur $8 tax out of $750 income. Tier 1 payments will incur tax of $118 assuming they are claiming tax free trhreshold from their employer

the February month to determine who receives 1200 or 750 is unfair for some of our casuals where they normally work these hours and more but in February they did not are only eligible to 750. It also means that our staff will be asked to the same work in less hours as they will only to be paid the jobkeeper amount. Some staff are still receiving a pay rise albeit a lot less and the rest another pay cut.