AHRI’s Quarterly Work Outlook report paints an interesting picture of the upcoming employment landscape in Australia, including employers’ pay, recruitment and redundancy intentions.

We’ve heard lots of discussion about what Australia’s labour market might look like in the near future, considering our uncertain economic situation. Will organisations reduce headcount as we’ve seen occurring overseas? Will inflation continue to outstrip wages? Will turnover increase as employees continue to reassess their relationships with work?

Of course, much of this is still unknown. However, AHRI has been able to put some data behind some of the most pertinent questions about the Australian labour market with our latest Quarterly Work Outlook report.

This quarter’s survey is based on sentiment from over 600 senior HR professionals and key business decision-makers in Australian organisations of varying sizes and sectors, assessing their pay, recruitment and redundancy intentions in comparison with data collected in the previous quarter.

Here’s a snapshot of some of the report’s insights for the September 2023 quarter.

The recruitment landscape

Our research showed strong employment growth for Q3 2023, with 44 per cent of businesses intending to increase staffing levels over the quarter while just three per cent intend to decrease employee numbers.

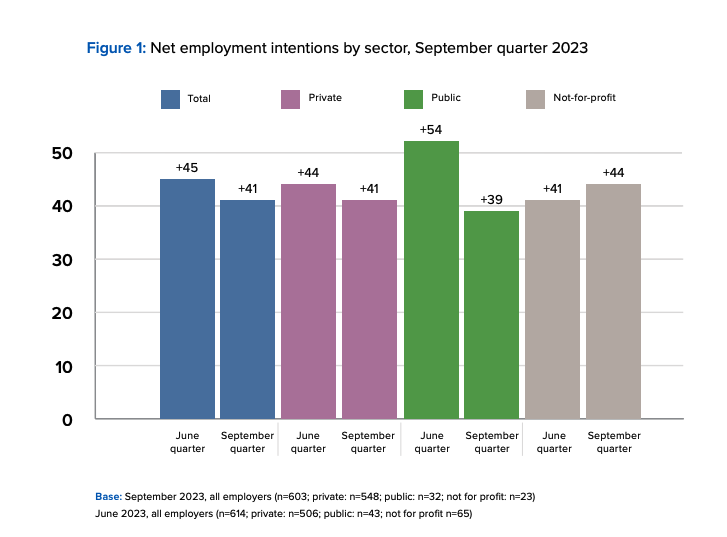

AHRI’s Net Employment Intentions Index, which measures the percentage of employers intending to increase staffing levels and subtracts the percentage intending to decrease staffing levels, is sitting at +41, down from +45 in the previous report.

The modest fall in projected employment growth is likely due to a slight softening in recruitment demand, but overall the results suggest that the impact of recent interest rate hikes on the demand for labour has yet to be felt.

The question is whether the employment market will pull back further, given subdued economic indicators and the easing of other measures in this quarter’s survey.

Despite positive employment intentions across all sectors, 43 per cent of Australian employers are facing challenges in getting the right talent in their organisations.

The main challenges cited were:

- A lack of suitable candidates (72 per cent)

- High salary expectations (45 per cent)

- Competition from rival organisations (37 per cent)

- Unattractiveness of the role (29 per cent)

This tells us that despite Australia’s low unemployment rate – which recently increased from 3.5 to 3.7 per cent – we’re still feeling the pinch of the pandemic in terms of a lack of global talent to help bolster specific industries.

As a panel of experts outlined at our National Convention and Exhibition in Brisbane earlier this month, the attractiveness of Australia’s job landscape has decreased in the wake of the pandemic, with a lot of great local talent moving overseas to pursue professional opportunities and a lack of permanent working options for those wishing to work in Australia.

The antidote to this, according to adidas’ Director of Talent Acquisition – Global Tech, Digital and DNA, Michael Bradfield, is to invest in and focus on global mobility strategies.

Speaking to HRM on this topic, he said: “We’ve lost a lot of really good knowledge out of this country and we’re left with a residual base at the moment. This is leaving a lot of organisations pretty short on what they can get. This means they’re not operating to their full potential.”

The solution to this challenge is multi-faceted and reliant on government support, but from an organisational perspective, Bradfield suggested focusing on and investing in internal global mobility capabilities to ensure this is part of your organisation’s strategic agenda.

Skills are lagging

One of the most startling figures to arise from this report was that 20 per cent of employees are perceived as not being proficient in their job.

One factor driving these skills gaps could be inadequate training. While 90 per cent of employers reported that they’ve provided some training over the past 12 months, on average, just over a quarter of employees undertook external training and only 45 per cent undertook internal training over the same period.

It’s promising to see four in ten employers say that training investment will increase at their organisation over the next 12 months, but it’s crucial that more organisations make this a priority, as Australia’s future prosperity will be built upon a skilled workforce that helps our nation to remain globally competitive.

Now is the time to invest in workplace training and the broader set of HR practices that boost organisational performance.

Redundancy intentions and turnover

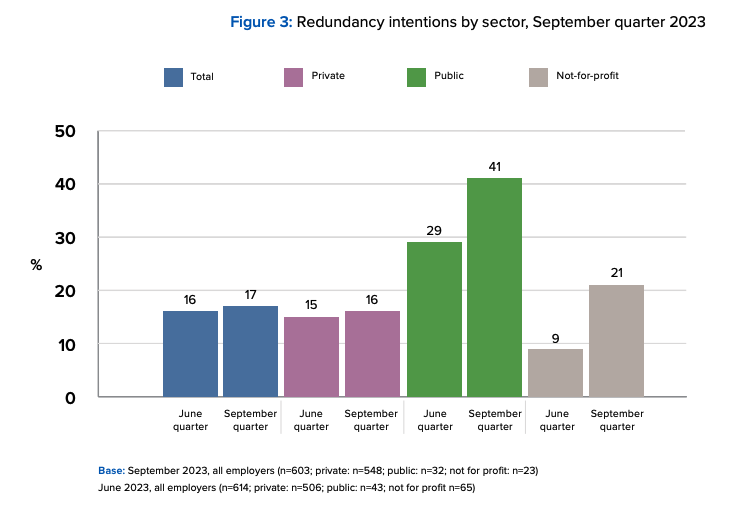

Less than one fifth (17 per cent) of employers are planning redundancies in the upcoming September quarter, which is consistent with the June quarter (16 per cent).

Read HRM’s article ‘When does a redundancy become an unfair dismissal’.

We also saw slight increases in the rate of employee turnover – 14 per cent compared to from 12 per cent in the previous quarter. It’s also worth noting that 23 per cent of organisations reported annual turnover of 20 per cent and above. This is broadly consistent with AHRI’s monthly voluntary turnover poll, which we run in the AHRI LinkedIn lounge, exclusive to AHRI members.

This could tell us that employees are continuing to change roles in search of greener pastures. Changing employee expectations following the pandemic, around benefits such as flexible work options, pay and mental health support, have caused some employers to lose some of their high-performers.

This could signal that it’s time for employers to rethink and refresh their employee value propositions in order to attract talent in the new world of work.

Read HRM’s article ‘78% of people wouldn’t work for a company without a formalised flexible work policy’.

Productivity challenges

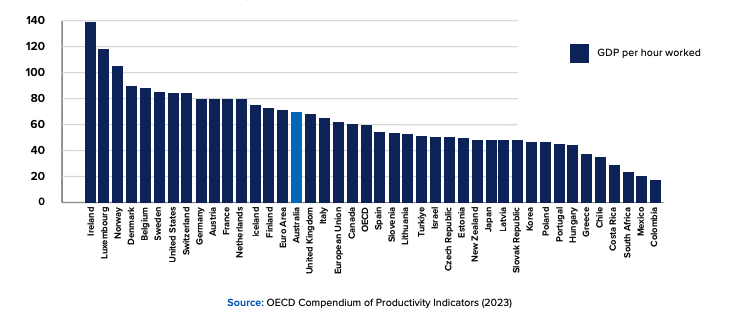

Australia’s productivity is falling short of many of our OECD competitors (see graph below), which is why AHRI wanted to get a better sense of if/how Australian businesses are measuring productivity, and what they’re doing to boost it.

An overwhelming majority of employers (92 per cent) reported measuring productivity in some shape or form. Among the options presented, the most frequently cited were:

• Customer satisfaction levels/feedback (35%)

• Revenue/sales per employee/team (33%)

• Employee engagement (32%)

• Process, project or task completion rates (32%)

• Profitability/margin per employee/ team (32%)

• Monitoring of hours worked/ timesheets (30%)

However, these metrics are often a measurement of business performance more broadly, rather than employee output – which is considered to be the benchmark for productivity. Only 20 per cent measured productivity this way.

In terms of improving productivity from an output perspective, the employers we surveyed believed flexible working arrangements (46 per cent), performance-related pay (36%) and on-the-job training (33%) were most effective.

It is encouraging that many employers are adopting high-performance work practices. However, it’s concerning that fewer are investing in line management capability (25 per cent), which is crucial to making fuller use of people’s skills to improve productivity.

The same goes for an investment in technology and AI, which only 20 per cent said they were actively doing. However, 26 per cent said this would be a near-term priority for them. If this occurs, it will be interesting to see how this impacts overall productivity levels.

For a deeper dive into the insights, you can download the full paper here. If you have any feedback or ideas for next quarter’s focus topic, please reach out to AHRI’s Research and Advocacy Specialist, Gerwyn Davies on gerwyn.davies@ahri.com.au.

Ensure your team is thinking and acting strategically at every stage of the employment lifecycle with this short course from AHRI.